By now, your home has probably been visited by one of the Field Inspectors working for Tyler Technologies. Tyler is the company that has been hired by New Castle County to conduct the first property tax assessment in the county since 1983. Since many of today’s homeowners have not experienced a property tax reassessment in New Castle County, it’s natural that there are many questions.

The most frequently asked question is “will my taxes go up” as a result of reassessment. The biggest factor to answer that question is how much the value of your house has grown compared to other houses throughout New Castle County.

· If your house’s value has grown more than the average house, your taxes are likely to increase.

· If your house’s value has grown about average for a house in New Castle County, your taxes are likely to remain the same.

· If the value of your house has increased by less than the average house, your taxes should actually go down.

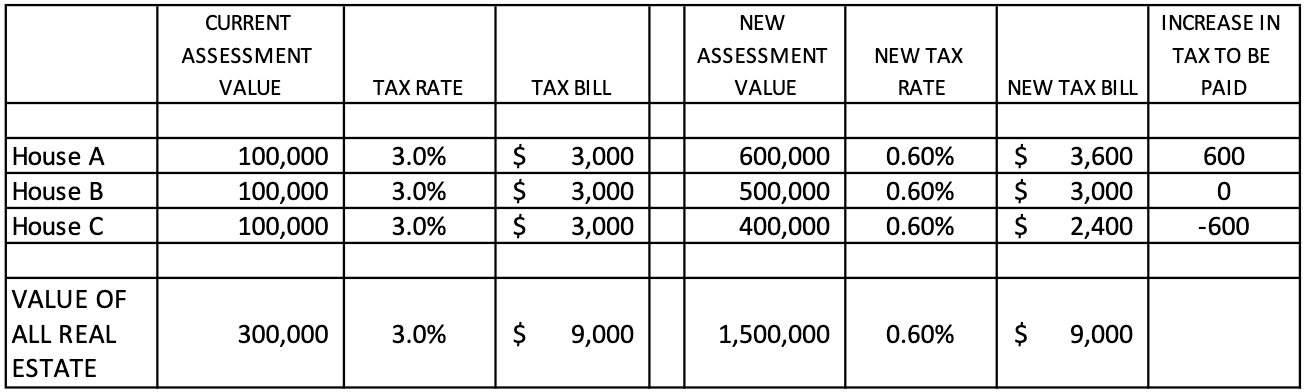

Let’s look at an example below where we simplify by assuming a county with only three houses.

In this hypothetical county all three homes are currently assessed at $100,000 and each pays $3,000 per year in real estate taxes. By the way, the current tax rates in New Castle County vary by municipality and school district but they are approximately 3.0% to 3.5% of your home’s assessed value per year. The assessed value means that the county decided at some point that these houses would have sold for $100,000 in 1983. Even if your house was built after 1983, the county estimated the cost that it would have sold for if it had been sold in 1983.

While each of these houses was estimated to be of the same value in 1983, they have each increased in value at different rates over the past 40 years. A growth rate of 4% per year over 40 years works out to about 5 times the original value. So, we shouldn’t be surprised to see the assessed value of our home jump by that amount during this assessment. For this example, we used that increase for the average house in our three-house county (“House B”).

While House B is now assessed to be worth $500,000, House A has increased in value by even more, to $600,000, while House C has “only” grown in value to $400,000. For the county’s tax collectors, the important figure is that the total value of houses is now worth $1.5 million, where they were previously worth $300,000. Currently, in order to collect $9,000 in total real estate taxes, the county applies a tax rate of 3%. However, after reassessment, $9,000 in taxes will be collected from a tax rate of 0.6%.

Applying the new tax rate of 0.6% results in the same total tax collected. However, in the table above we can see that the owner of House A will now pay $600 more in tax, offsetting a reduction of the same amount by the owner of House C – the amount of tax on House B remains unchanged.

Will our TAX RATES dramatically fall similar to this example: most likely, yes. In fact, state law does include some level of protection. The county may set a tax rate which results in a higher overall level of taxes, but it is limited to an overall increase of 15% [see the code]. Last November, County Councilmembers John Cartier and Dee Durham attended an information session sponsored by the Council of Civic Organizations of Brandywine Hundred (CCOBH) where they informed attendees that the County Council had passed a resolution committing that they will not use the reassessment as an occasion to increase overall tax revenue.

Of course, if you’ve looked at your county real estate tax bill you may have noticed that approximately three quarters of our bill is made up of school taxes. State law also carries some taxpayer protection in the case of school taxes; increases in overall school taxes collected in connection with property tax reassessment are limited to 10% [see the code]. We reached out to board members of the Brandywine and Red Clay school districts to ask whether their boards were taking a similar stance as the County Council. Both told me that their board’s intention was to maintain a ”revenue neutral” position following the reassessment.

By November of this year, homeowners will be receiving their new assessment values. While those values will represent significant increases over current assessed values, the average tax bill is expected to remain unchanged. However, individual homeowners will see tax bills vary depending on how much their individual property value has grown.

Next time I’ll write about the timeline for the remaining reassessment process and the steps to take if you think there is something inaccurate about your own reassessment.